Exports -whether oil-related or non-oil- stand as a fundamental economic indicator, playing a pivotal role in assessing a country's economic strength and viability. crucial instrument for strategic-decision-making. The impact of net exports extends across various economic dimensions, influencing the dynamics of the labor force, inflation rates, and economic growth. In Saudi Arabia, the rise in non-oil exports signifies a successful achievement in economic diversification. This diversification is prominently manifested in various sectors, including petrochemical, plastic, basic metals, and electrical machinery industries. The concerted growth of these sectors contributes significantly to the realization of economic diversification goals and the fostering of economic stability.

Vision 2030 and Economic Transformation:

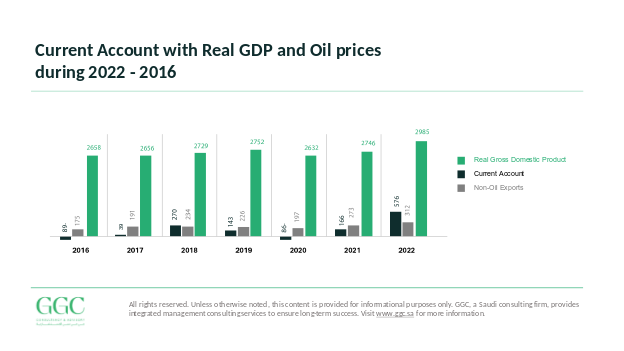

Saudi Arabia's Vision 2030 represents a strategic shift from traditional reliance on oil to building a more sustainable economic foundation. Our descriptive analysis below shows a significant 78.3% increase in non-oil exports, amounting to 137 Billion Saudi Riyals. This growth corresponds with a 12.3% rise in the Real Gross Domestic Product (GDP) and an impressive 743.7% surge in the current account. This interconnected growth highlights the dynamic interaction between local economic expansion and the remarkable growth in exports and the current account

Empirical Analysis of the Economic Indicators:

Empirical Analysis of the Economic Indicators:

Utilizing a Vector Error Correction Model, our analysis examines the short- and long-run relationship between non-oil exports and the current account, considering the influence of oil exports and real gross domestic product in Saudi Arabia from Q1 2016 to Q2 2023.

Notably, our findings indicate that(ceteris paribus):

A 1% increase in non-oil exports leads to a 5% increase in the current account in the short term (ceteris paribus).

Furthermore, a 1% increase in oil exports results in a 3.5% decrease in the current account in the short term, but results in an increase in the current account by 2% in the long term. The short term results are attributed to the direct positive impact of oil exports on national income and consumption expenditure.

In the long term, a 1% rise in Real GDP has a negative effect on the current account by 6%. This is also due to the accompanying increase in income, raising the proportion of consumption expenditure.

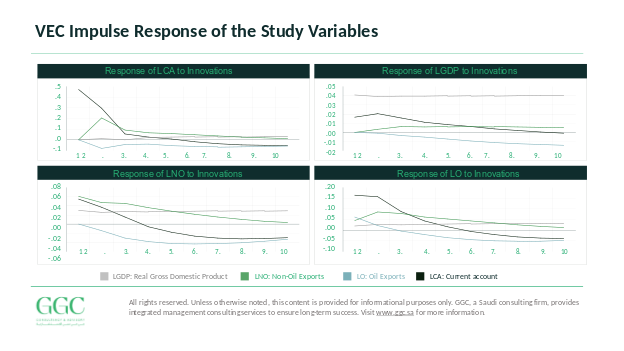

Impulse Response Function Analysis

The Impulse Response Function reflects the impact of a shock to the same indigenous variable or on another variable. This test enables us to discover the reactions of each variable to innovations originating from other variables, which plays a crucial role in the forecasting process.The graphical representation delineates the percentage of an index's response to shocks, thereby exemplifying the complex interplay between Real GDP, non-oil exports, oil exports, and the current account.

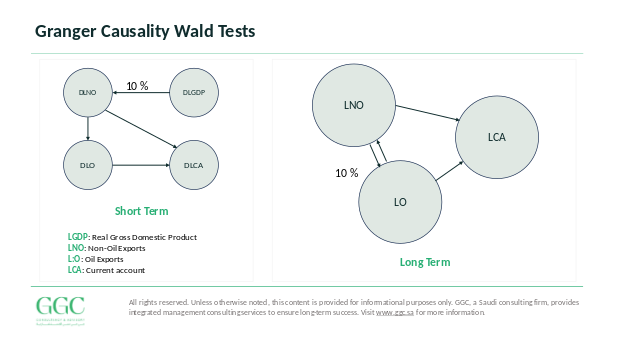

Granger Causality Test Insights

Granger Causality Test Insights

This test examines whether one time series can predict another in both the short-and -long-term. The analysis indicates that the short-term economic growth in Saudi Arabia will Granger cause Non-oil Exports, contributing to both short and long-term improvements in the Current Account.

Simultaneously, sustained growth in oil exports aligns with efforts to strengthen non-oil exports, showcasing the Kingdom's dedication to achieving Vision 2030 by aiming for non-oil exports to constitute 50% of the non-oil gross domestic product, as illustrated in the figure below.

Recommendations for Achieving Sustainable Growth:

Recommendations for Achieving Sustainable Growth:

This analysis puts forward a number of strategic, export-focused recommendations aimed at enhancing economic development and ensuring the sustainable success of Vision 2030.

- Economic diversification focus

Emphasize the promotion of economic diversification and strategic investments in key sectors, with a particular emphasis on the development of the agricultural and industrial segments to harness growth benefits and generate employment opportunities.

- Stimulating investment and supporting export sectors

Prioritize the incentivization of investments and the fortification of market dynamics through judicious monetary policies, directing foreign exchange policies to augment competitiveness.

- Infrastructure development for enhanced competitiveness

Prioritize the enhancement of electricity infrastructure to mitigate costs and elevate productivity, thereby reinforcing competitiveness in non-oil exports.